+242 pips

+32 %

Wednesday, March 31, 2010

Tuesday, March 30, 2010

Time for pause

More of bad trading. I'm angry at myself because I did fall out of rhythm that I had. Now all my attention is on p&l. Don't want to close trades when they are no good, so I start averaging moving stops and just plain trading bad.

Maybe I really shouldn't trade at all when I feel confused like now and without clear goal. I start trading because of fear of missing out but I'm not in shape for it. Psychologically I feel different then rest of this month and this pushing myself in is just making things worse. Then I have a thought well when will I get mentally focused, what if it's never? I can't give those answers but I can objectively say that my mind isn't now in adequate state for quality trading.

Then I'm angry because things are like that. Like how could I be so focused and trading good before? What has changed?

One bad day last week, but not bad because it was day with loss but because I pushed so hard to make it profitable even if I was wrong. It changed me the same way as I get changed in bad day when I lose control. Now I'm just not suitable for trading until I get suitable. Before I would just come and trade more and lose like in a period before current positive run. One day I would just get awaken from that bad dream and start doing good things and change cycle to positive. Maybe I should just wait it out.

Today plenty of risk mainly to get me above break even. Totally unnecessary and risky. Am I happy now when I'm positive for the day? NO.

+8 pips

Maybe I really shouldn't trade at all when I feel confused like now and without clear goal. I start trading because of fear of missing out but I'm not in shape for it. Psychologically I feel different then rest of this month and this pushing myself in is just making things worse. Then I have a thought well when will I get mentally focused, what if it's never? I can't give those answers but I can objectively say that my mind isn't now in adequate state for quality trading.

Then I'm angry because things are like that. Like how could I be so focused and trading good before? What has changed?

One bad day last week, but not bad because it was day with loss but because I pushed so hard to make it profitable even if I was wrong. It changed me the same way as I get changed in bad day when I lose control. Now I'm just not suitable for trading until I get suitable. Before I would just come and trade more and lose like in a period before current positive run. One day I would just get awaken from that bad dream and start doing good things and change cycle to positive. Maybe I should just wait it out.

Today plenty of risk mainly to get me above break even. Totally unnecessary and risky. Am I happy now when I'm positive for the day? NO.

+8 pips

Friday, March 26, 2010

One of those days

It's definitely hard to stop in a day like this. Also when I trade this way I make mistake of not closing position when I have good price for it but I want that position to recover all the loss. It's not attractive to close some bad trade at break even or so but I'm looking for one more push. When it doesn't come I have far worse situation than seconds ago and closing then is even less attractive.

I don't even remember what I was thinking through the day in all those trades. It's just a mess now when I look at it.

-26 pips

I don't even remember what I was thinking through the day in all those trades. It's just a mess now when I look at it.

-26 pips

Thursday, March 25, 2010

Thursday

Wednesday, March 24, 2010

Market wilderness

Untypical market with lot's of going on isn't making things easier on scalping front. On my first entry with some slippage gbp/usd tried three times in fifteen minutes to break above with no success. Then when it did it painfully stopped and refused to move with ease and strength which should be expected. So there I shake myself out from pretty much risky trade that I held for long time just when it broke out.

Second gbp/usd trade was intended to capitalize on all longs that are getting in red with now market moving down. It didn't move much on eur/gbp so it was only half success.

In a mean time usd/jpy was flying up like crazy. Then suddenly eur/usd started losing ground and it was obvious on 5 min chart that those lows are going to get hit. Well it lost some prior to my short but it was all recoverable. I was lucky to notice change of speed that happened 30 seconds before the break down and had successful entry. Add to all volatility today that Oanda's platform was problematic and after break it completely freeze. That's rare to see on Oanda but probably at least ones a year.

Few days ago I decided to stop widening my stop beyond my predefined take profit level of twenty pips when market is moving my way. When I move it I usually punch out sooner then my original t/p. So this way I can at least have goal oriented tension to wait out for green dot.

If Oanda didn't have problems I would probably trade more because my adrenaline was up, but there wasn't much tradable action anyway because some kind of low was formed up.

+22 pips

Second gbp/usd trade was intended to capitalize on all longs that are getting in red with now market moving down. It didn't move much on eur/gbp so it was only half success.

In a mean time usd/jpy was flying up like crazy. Then suddenly eur/usd started losing ground and it was obvious on 5 min chart that those lows are going to get hit. Well it lost some prior to my short but it was all recoverable. I was lucky to notice change of speed that happened 30 seconds before the break down and had successful entry. Add to all volatility today that Oanda's platform was problematic and after break it completely freeze. That's rare to see on Oanda but probably at least ones a year.

Few days ago I decided to stop widening my stop beyond my predefined take profit level of twenty pips when market is moving my way. When I move it I usually punch out sooner then my original t/p. So this way I can at least have goal oriented tension to wait out for green dot.

If Oanda didn't have problems I would probably trade more because my adrenaline was up, but there wasn't much tradable action anyway because some kind of low was formed up.

+22 pips

Tuesday, March 23, 2010

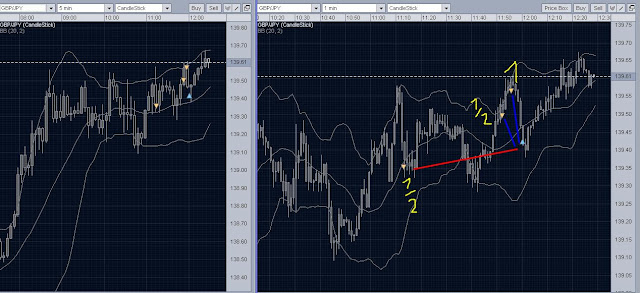

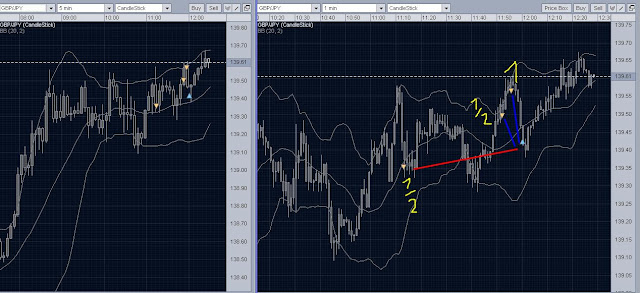

Trading the move

This move down surprised me. Gbp weakness came out of nowhere. Eur/usd didn't move much but eur/gpp started flying up. I would bet more on the up side then down while I was watching the chart because I couldn't find much pressure from the down ticks while pair was in that tight range. When move started I didn't second guess it but trade it.

+16 pips

+16 pips

Monday, March 22, 2010

Friday, March 19, 2010

End to good week

I'm finished before I even started. One usual scalp and after I didn't wan't to risk any more. I guess that I have need and mini goal each day to be profitable. It doesn't include maximizing profits. When I have satisfactory profit that's it. Profits add up and I don't want to fix thing that isn't broken. Anyway I always tell myself when I'm in bad shape that I should scalp, take small profit and run. Reason I write this is because I have conflict. I feel like I should trade more and anxiety that this isn't good. I guess that kind of trading is going against subconscious collective belief that work should be hard and take long hours.

+16 pips

+16 pips

Thursday, March 18, 2010

Thursday

I exit first trade at the place where I would usually go in. Lately I found myself in many occasions where market just stop at the low without breaking it, so I didn't push for it. Second long trade also show much of potential after my exit, but I don't want to complain. This is ok as it is.

+16 pips

+16 pips

Wednesday, March 17, 2010

Unprepared for volatility

I made a mistake of not adjusting my size to volatility. This would be perfectly ok for half size trade but not for full size. That drop was hitting at morning lows and it could go either way and market was very fast. Luckily it finished well but it could have been costly.

After few days of constant winning it's easy to just drift away and not pay attention. Only to get awaken with big loss somehow showing at charts

+13

After few days of constant winning it's easy to just drift away and not pay attention. Only to get awaken with big loss somehow showing at charts

+13

Tuesday, March 16, 2010

Monday, March 15, 2010

Isolating scalps from big picture

I was thinking over weekend how I should concentrate on isolating my scalp trades from the big picture. By that I mean that I watch closely what is going on and always guess on movements that are basically swing trades. My trades are scalps but when I'm in them I consider them like I will catch some big move. It would be better to find opportunities like I do an just take scalp profit and don't look back what will market do. Two, three trades like that in a day and that is my job.

Today those thoughts turned in a way I was trading. I found good spots for immediate move on one side or another, took trades and took profits when I consider them good for today's market. I didn't bother myself with thinking will the market go fifty pips up or down after my trades. I didn't put any emphasis on catching the bigger move. The thing is even thou you can't see on my charts any bigger moves that I captured I always consider that in my mind while I trade. So that is just empty thinking and losing energy and focus. That's what I think when I say that I should only scalp. In reality I do only scalp, but in my mind it's like I'm catching 50-100 pips moves all the time. That is useless and counterproductive.

It's o.k. to be conscious about what is going on on higher time frames and base my scalps on that but when I have my scalp profit just say good bye and never look back. Only for next short opportunity for another scalp entry.

I'm basically talking about my Friday's trading where I was in active market and I lost myself in trying to catch big move, while I neglected to use market movements to find good places for scalps that were available. Today I done just that and I'm proud of it. Two, three good trades should be my goal for a day before I sit down in front of my screen and not catching 50-100 pips move because I never do it and don't trade good that way.

Later I tried to catch any meaningful bounce with half size trades but there wasn't one. I expected some value buying but market just cleared all of Fridays advance. In reality I was empty for further trading after first two successful trades, so those were not so good actions on my part anyway. When I'm not any more for trading I'm in no mood to follow the trend, that's why I chose those trades.

+24

Today those thoughts turned in a way I was trading. I found good spots for immediate move on one side or another, took trades and took profits when I consider them good for today's market. I didn't bother myself with thinking will the market go fifty pips up or down after my trades. I didn't put any emphasis on catching the bigger move. The thing is even thou you can't see on my charts any bigger moves that I captured I always consider that in my mind while I trade. So that is just empty thinking and losing energy and focus. That's what I think when I say that I should only scalp. In reality I do only scalp, but in my mind it's like I'm catching 50-100 pips moves all the time. That is useless and counterproductive.

It's o.k. to be conscious about what is going on on higher time frames and base my scalps on that but when I have my scalp profit just say good bye and never look back. Only for next short opportunity for another scalp entry.

I'm basically talking about my Friday's trading where I was in active market and I lost myself in trying to catch big move, while I neglected to use market movements to find good places for scalps that were available. Today I done just that and I'm proud of it. Two, three good trades should be my goal for a day before I sit down in front of my screen and not catching 50-100 pips move because I never do it and don't trade good that way.

Later I tried to catch any meaningful bounce with half size trades but there wasn't one. I expected some value buying but market just cleared all of Fridays advance. In reality I was empty for further trading after first two successful trades, so those were not so good actions on my part anyway. When I'm not any more for trading I'm in no mood to follow the trend, that's why I chose those trades.

+24

Friday, March 12, 2010

GBP

I'm not really satisfied how I traded today's market. Even thou it can act strangely with small range of 2 pips on the high for several minutes I should trade probabilities. So first trade as continuation of trend was closed too early to protect small profit. Previous move up in reality happened in 3 minutes total so there is strength in up side and it didn't move as much at that point.

Next short was stupid just because it's ten pips of the high. If I believe we are going down or that market isn't going more up I need to find good place for my trade. Not just jump in wherever because it's against the trend on higher time frames and those are just opportunities for retracement entry. So scalping like that need to be initiated at extremes and not middle of the range. Then I closed that trade without it break to the new high at worst possible price. That's the place for shorting and fading if I'm going to do that.

Third trade was more like emotional, revenge trade when I found out that I foolishly closed previous in the loss.

Final one was there because I wanted to close day in the profit and not in the loss. It worked and I caught nice bounce.

There is no problem in scalping, but when I want to scalp I need to focus on small moves and trades that will capture them. My mind is jumping between bigger moves that are obvious possibility and scalping. In the end I scalp, but then I have to make sure to scalp good.

+4 pips

Next short was stupid just because it's ten pips of the high. If I believe we are going down or that market isn't going more up I need to find good place for my trade. Not just jump in wherever because it's against the trend on higher time frames and those are just opportunities for retracement entry. So scalping like that need to be initiated at extremes and not middle of the range. Then I closed that trade without it break to the new high at worst possible price. That's the place for shorting and fading if I'm going to do that.

Third trade was more like emotional, revenge trade when I found out that I foolishly closed previous in the loss.

Final one was there because I wanted to close day in the profit and not in the loss. It worked and I caught nice bounce.

There is no problem in scalping, but when I want to scalp I need to focus on small moves and trades that will capture them. My mind is jumping between bigger moves that are obvious possibility and scalping. In the end I scalp, but then I have to make sure to scalp good.

+4 pips

Thursday, March 11, 2010

Slow and sleepy market

Slow markets, I don't like 'em. Most sound was first trade which was initiated after gbp news time. It was irrelevant news, no widening of spread. I went in the direction of the price with half size because it was trading in the dark for me.

Second trade was based on momentum that vanished after my entry. Third short was idea that things will stop it's advance based on overall situation in pairs that I follow. The slowness kicked me out. Reversal didn't occur anyway.

+11 pips

Second trade was based on momentum that vanished after my entry. Third short was idea that things will stop it's advance based on overall situation in pairs that I follow. The slowness kicked me out. Reversal didn't occur anyway.

+11 pips

Wednesday, March 10, 2010

Emotion of thrill

Emotion of thrill overwhelmed me as soon as I made my two quick wins. After it I wasn't able to trade any more, even thou I made quick trip in other pair but run away immediately when it wasn't working and that was good choice. Positive emotions are just like negative, emotions. They change things. It's easy to leave charts in such state, good thing is that it don't make me want to trade more. If I for some reason chose to trade again I don't want to lose my precious just made profit and that is not even remotely good state to be when you are trading.

Second gbp/usd trade against the trend was made because gbp/jpy held yesterday's support and low at that moment. From that followed reversal.

More I look at my trading I can see that I'm searching for this kind of setups. Break to the new low/high quick action on 10sec chart, scalp and out. When price is moving fast on 10sec in this type of situation I can sense what is going on. At least I believe so and I'm able to trade based on that belief.

+25 pips

Second gbp/usd trade against the trend was made because gbp/jpy held yesterday's support and low at that moment. From that followed reversal.

More I look at my trading I can see that I'm searching for this kind of setups. Break to the new low/high quick action on 10sec chart, scalp and out. When price is moving fast on 10sec in this type of situation I can sense what is going on. At least I believe so and I'm able to trade based on that belief.

+25 pips

Tuesday, March 9, 2010

Killing me softly market

Monday, March 8, 2010

Monday afternoon

Wednesday, March 3, 2010

Swing trading

First trades in gbp/usd were after favorable news for gbp with half size. Add on was too early. I "sold myself a story" that I will buy it at lower price so I was able to exit the trade with small loss of -5 full size pips, untypical for me.

Next was long in eur/usd after some retrace, and soon additional trade in gbp/usd also expecting price going back to it's highs. It was long wait, with problems in gbp/usd not holding like eur/usd.

Eur/usd started rallying moving 20 pips in 3 minutes. Much of the move was on eur/gbp strength so gbp/usd didn't follow as quickly. It could have been exceptional break out if it did, maybe it will be later.

+44 pips

Next was long in eur/usd after some retrace, and soon additional trade in gbp/usd also expecting price going back to it's highs. It was long wait, with problems in gbp/usd not holding like eur/usd.

Eur/usd started rallying moving 20 pips in 3 minutes. Much of the move was on eur/gbp strength so gbp/usd didn't follow as quickly. It could have been exceptional break out if it did, maybe it will be later.

+44 pips

Subscribe to:

Comments (Atom)